Inventory Aging Best Practices for Used Car Dealers

Master inventory aging analysis: optimal turnover targets, aging thresholds, pricing strategies to minimize carrying costs and maximize profit.

Inventory aging is the number one profit killer for independent used car dealers. Every day a vehicle sits on your lot costs money—floor plan interest, insurance, depreciation—while tying up capital that could purchase faster-turning inventory. Dealers with disciplined aging management average 6-8 inventory turns per year; those without systems average 3-4 turns and bleed cash.

This guide provides actionable inventory aging strategies used by profitable independent dealers: aging thresholds, pricing triggers, carrying cost calculations, and turnover optimization. Master these practices to reduce days in stock, minimize price erosion, and maximize inventory ROI.

Understanding Inventory Aging Metrics

Effective aging management starts with tracking the right metrics. Most dealers focus solely on average days in stock, but profitable dealers monitor multiple aging indicators to spot problems early.

1. Key Aging Metrics to Track

- Average Days in Stock: Total days in stock for all vehicles ÷ number of vehicles. Target: 45-60 days for general used car dealers. Lower is better but must balance with acquisition volume.

- Inventory Turnover Rate: 365 days ÷ average days in stock. Example: 60-day average = 6 turns/year. Higher turnover reduces carrying costs exponentially.

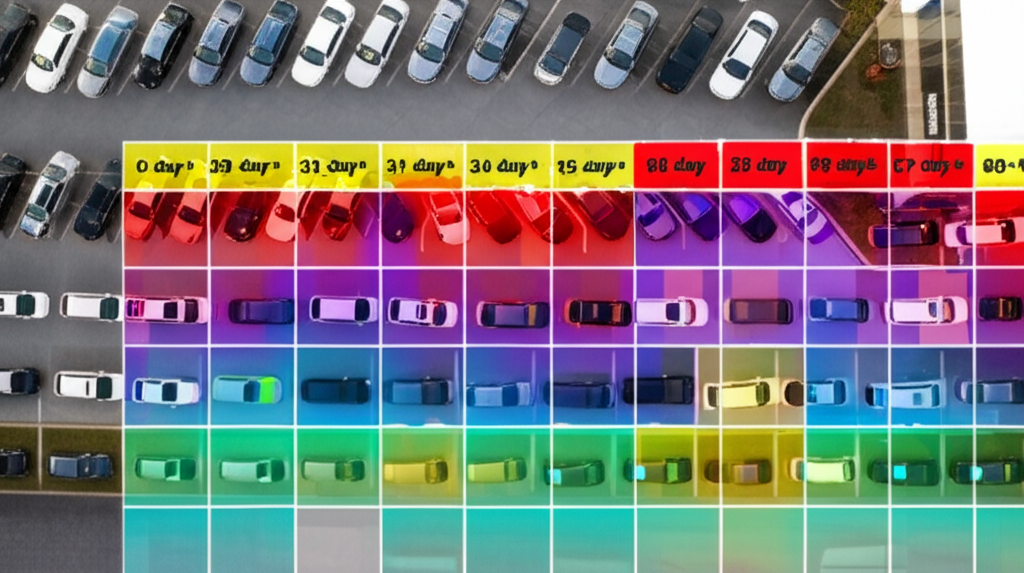

- Aging Bucket Distribution: Percentage of inventory in each bucket (0-30, 31-60, 61-90, 90+). Healthy distribution: 60% in 0-30 days, 25% in 31-60 days, 10% in 61-90 days, 5% in 90+ days.

- Cost to Carry: Floor plan interest + insurance + depreciation per vehicle per month. Typical: $150-300/month per vehicle. Compounds quickly on aged inventory.

- Aged Inventory Ratio: Percentage of units over 60 days. Red flag threshold: >20%. Indicates pricing issues, acquisition missteps, or recon delays.

2. Aging Calculation Best Practices

Start aging clock from acquisition date (not listing date). This forces accountability for recon delays. If you wait 10 days to list a vehicle, that's 10 days of floor plan interest with zero sales activity—unacceptable.

| Aging Start Point | Pros | Cons |

|---|---|---|

| Acquisition Date (Recommended) | Accountability for recon speed, true cost calculation | None (this is the correct method) |

| Listing Date | Easier to justify slow recon | Hides recon inefficiency, understates costs |

| Front-Line Ready Date | Focuses on retail sellability | Ignores pre-retail carrying costs |

Optimal Aging Thresholds and Action Triggers

Aged inventory doesn't happen overnight—it's the result of missed action triggers at key milestones. Disciplined dealers use automated aging alerts to force timely decisions.

1. 30-Day Milestone: Market Validation

What it means: Vehicle has been available for one month. If zero test drives or serious inquiries, pricing or positioning is wrong.

- Action 1 - Review Market Position: Compare price to similar vehicles on CarGurus, AutoTrader. Are you priced above market? Adjust to match or undercut top-rated listings.

- Action 2 - Improve Merchandising: Add photos if less than 20, rewrite description to highlight unique features, verify all options are listed correctly.

- Action 3 - Boost Visibility: Upgrade to featured placement on marketplaces, run Facebook Marketplace promotion ($20-50 budget can generate leads).

2. 60-Day Milestone: First Price Reduction

Critical threshold: Most buyers won't consider vehicles over 60 days ("Why hasn't it sold?"). First price adjustment required.

- Reduction Amount: 3-5% below current asking price (typically $500-1,500 depending on vehicle price). Large enough to trigger new leads but preserves gross potential.

- Psychological Trigger: Price reduction shows on CarGurus/AutoTrader as "Price Drop" badge, sends alerts to saved-search buyers watching similar vehicles.

- Market Repricing: Don't reduce if new comparable listings came online higher than yours—your vehicle is now competitively priced by market movement.

3. 90-Day Milestone: Aggressive Action Required

Red flag territory: Vehicle approaching or exceeding 3 months in stock. Carrying costs have likely exceeded $400-900. Time for decisive action.

| Scenario | Recommended Action | Expected Outcome |

|---|---|---|

| Recent leads/test drives | Second price reduction (5-8%), follow up with all leads | Sale within 2 weeks or wholesale |

| Zero activity, needs repairs | Wholesale immediately (avoid sinking more cost) | Cut losses, recover capital |

| Unique vehicle, limited demand | Expand marketing radius (regional ads), consider dealer trade | Find buyer in broader market |

| Seasonal mismatch (convertible in winter) | Wholesale or deep storage until spring | Avoid further depreciation |

Carrying Cost Calculation and Impact

Many dealers underestimate carrying costs, leading to delayed wholesale decisions. Calculate true cost to carry each vehicle monthly.

1. Floor Plan Interest

Typical cost: $50-150/month per vehicle depending on loan amount and interest rate. Example: $20,000 vehicle @ 8% annual = $133/month interest.

Compounding effect: Vehicle in stock 90 days = $400 floor plan interest. That's $400 you must recover in gross profit before making any real profit. Many aged vehicles sell at a loss once carrying costs are included.

2. Depreciation and Market Value Erosion

Average depreciation: Used vehicles lose 1-2% of value per month simply from age/mileage stigma. A 60-day-old listing appears stale to buyers regardless of condition.

- Market perception: "Why hasn't it sold?" triggers buyer skepticism, forcing price reductions beyond normal depreciation.

- Wholesale value decay: Auction buyers penalize aged inventory heavily. A vehicle wholesale value drops $500-1,000 for every 30 days over 60 days in stock.

- Seasonal shifts: Vehicle acquired in fall may face winter demand drop (SUVs exception), requiring deeper discounts than anticipated.

3. Total Cost to Carry Example

Example: $18,000 Used Sedan, 90 Days in Stock

Floor plan interest (90 days @ $120/mo): $360

Insurance (allocated): $75

Depreciation (3 months × 1.5%): $810

Total carrying cost: $1,245

If you bought at $15,000 and sell retail at $17,500 after carrying costs, net profit is $1,255 - not the $2,500 gross you calculated. Lesson: Move inventory fast or wholesale early.

Preventing Inventory from Aging

Best aging strategy: Don't acquire vehicles that will age. Prevention requires discipline at acquisition, recon, and pricing stages.

1. Acquisition Strategy: Buy What Sells Fast

- Historical analysis: Review your last 50 sales - what made/models/price points sold in under 30 days? Focus acquisitions on proven performers in your market.

- Market demand verification: Before buying at auction, check CarGurus/AutoTrader for how many similar vehicles are listed locally and how long they've been active. Oversupplied market = trouble.

- Avoid "great deal" syndrome: Buying a vehicle $2,000 below book sounds great until it sits 120 days because nobody in your market wants that make/model. Margin means nothing if the vehicle doesn't sell.

- Set acquisition limits: No more than 2-3 units of the same make/model/year unless you have proven demand. Diversify inventory to capture more buyer segments.

2. Recon Speed: 5-7 Day Target

Recon delay is inventory aging. Every day a vehicle waits for detailing, photos, or mechanical work is a day of floor plan interest with zero sales opportunity.

- Day 1-2: Mechanical inspection and immediate repairs (if minor). Major repair needs? Wholesale decision now, not later.

- Day 3-4: Detailing (interior/exterior), professional photos (minimum 20 images), VIN decoding/option verification.

- Day 5: Pricing analysis, create listing with detailed description, syndicate to all marketplaces.

- Day 6-7: Quality check (verify listing accuracy, confirm photos uploaded), activate featured placement if competitive market.

3. Day-1 Competitive Pricing

Biggest mistake: Pricing high "to leave room to negotiate" then reducing price 45 days later after zero activity. You wasted 45 days of carrying costs and created market stigma.

- Market-based pricing: Price at or slightly below median of comparable vehicles in your market from day 1. Generate immediate activity, sell fast, move on to next vehicle.

- Cost-plus trap: "I have $12k in it so must ask $15k" ignores market reality. If market says $13.5k, you either accept lower gross or vehicle ages (costing more than the gross you're protecting).

- Fastest-turn strategy: Price in bottom quartile of market (but not lowest—triggers suspicion). Sell in 15-30 days, 8-10 turns/year, higher annual profit than slow-turn dealers protecting per-unit gross.

Frequently Asked Questions

What is inventory aging in a car dealership?

Inventory aging tracks how long each vehicle has been in stock (days from acquisition to today). Aged inventory ties up capital, increases carrying costs (floor plan interest, insurance), and typically requires price reductions. Most dealers track aging in buckets: 0-30 days, 31-60 days, 61-90 days, 90+ days.

What is a good inventory turnover rate for used car dealers?

Healthy turnover: 45-60 days average (6-8 turns per year). High-volume dealers: 30-45 days (8-12 turns). Specialty/luxury dealers: 60-90 days (4-6 turns). Turnover rate = 365 days ÷ average days in stock. Faster turnover reduces carrying costs but requires efficient acquisition/recon workflows.

When should I reduce price on aged inventory?

First price adjustment: 45-60 days (reduce 3-5% to test market response). Second reduction: 75-90 days (additional 5-8%, consider wholesale if no activity). Critical threshold: 90+ days (aggressive pricing or wholesale to avoid sunk costs). Never wait until 120+ days - losses compound quickly.

How do I prevent inventory from aging?

Buy right: Acquire vehicles with proven demand in your market. Price competitively: Use market-based pricing from day 1 (not cost-plus). Recon fast: Complete photos/mechanical/detailing within 5-7 days of acquisition. Syndicate widely: List on all major marketplaces within 24 hours. Review weekly: Flag vehicles at 30/60 days for action.

What are the hidden costs of aged inventory?

Floor plan interest: $50-150/month per vehicle depending on loan amount. Insurance: Continues while unsold. Depreciation: Vehicles lose 1-2% value per month in stock. Opportunity cost: Capital tied up that could buy faster-turning inventory. Staff time: Aged units require more follow-up, price changes, and manager attention.

Should I wholesale aged inventory or keep reducing price?

Wholesale when: Vehicle at 90+ days with no activity, repair costs exceed expected gross, unique vehicle with limited local demand. Keep retailing when: Recent leads/test drives indicate buyer interest, minor price reduction likely triggers sale, vehicle fills inventory gap in your lineup. Calculate break-even: Compare retail gross (after additional carrying costs) vs wholesale offer.

Automate your inventory aging management. DealerOneView DMS tracks days in stock from acquisition, sends aging alerts at 30/60/90 day milestones, and calculates carrying costs automatically. Built-in market pricing data helps you price competitively from day 1. Setup in 24-48 hours, pricing starts at $199/month.

Related Articles

Get More Insights Like This

Subscribe to our newsletter for the latest dealership tips and industry trends.