Lost Lead Analysis: Why Deals Fall Through

Analyze lost deals: common objections, price vs competitor gaps, process breakdowns. Use lost sale data to improve close rates.

If your dealership closes 20% of leads, what happened to the other 80%? Most dealers never find out. Leads are marked "dead" in the CRM with vague notes like "Not interested" or "Went with competitor," but no systematic analysis of why deals fall through.

Lost lead analysis is the process of categorizing, tracking, and analyzing why customers don't buy after expressing interest. By identifying the top 3-5 reasons leads are lost, dealerships can fix specific problems: if 40% of lost leads cite "price too high," you have a pricing or value communication issue; if 30% cite "couldn't find right vehicle," you have an inventory or merchandising problem.

Dealers who systematically analyze lost leads reduce loss rates by 20-30%, which translates to 15-30% higher conversion rates. A 20% conversion rate increasing to 26% = 30% more sales from the same lead volume.

This guide covers lost lead tracking systems, common loss reasons, root cause analysis, re-engagement strategies, and CRM automation for continuous improvement.

Why Analyze Lost Leads?

The Math of Lost Lead Reduction

Scenario: Dealership receives 200 leads/month, converts 20% (40 deals), loses 80% (160 leads).

If you reduce lost leads by just 10% (recover 16 leads at 20% conversion = 3 additional sales):

- Current: 200 leads → 40 sales (20% conversion)

- After 10% reduction: 200 leads → 43 sales (21.5% conversion)

- Impact: 3 additional sales/month × 12 months = 36 more deals/year

- Revenue impact: 36 deals × $2,500 gross = $90,000 additional profit/year

Key Insight: Small improvements in lost lead recovery create massive revenue gains.

What Lost Lead Analysis Reveals

- Sales process gaps: Are reps responding fast enough? Following up enough?

- Pricing issues: Are you consistently losing on price to competitors?

- Inventory mismatches: Do customers want vehicles you don't stock?

- Competitor advantages: Which competitors are you losing to? Why?

- Financing barriers: Are customers being declined for credit?

- Rep performance variance: Do some reps lose more leads than others? Why?

Lost Lead Categories & Tracking

Standardized Lost Reason Categories

Create CRM dropdown with these standard categories (customize to your dealership):

| Lost Reason | What It Means | Typical % of Lost Leads |

|---|---|---|

| Price Objection | Customer said vehicle/payments too expensive | 25-35% |

| Inventory Mismatch | Couldn't find right vehicle (color, features, type) | 15-25% |

| Bought from Competitor | Customer purchased from another dealership | 20-30% |

| No Response | Customer stopped responding (calls, emails, SMS) | 15-25% |

| Timing/Not Ready | Customer still shopping, not ready to buy | 10-15% |

| Financing Declined | Could not get approved for credit | 5-10% |

| Vehicle Sold | Vehicle customer wanted sold before they could buy | 3-8% |

| Trade-In Value Disagreement | Customer unhappy with trade-in offer | 5-10% |

| Poor Sales Experience | Customer cited rude/unhelpful sales rep | 2-5% |

| Other/Unknown | Reason unclear or doesn't fit categories | < 5% |

CRM Lost Lead Tracking Fields

When sales rep marks lead as "Lost," CRM should require:

- Lost Reason (dropdown): Select from standardized categories above

- Lost Date: When customer definitively declined

- Lost Notes: Free-text details (e.g., "Customer said payments were $150/mo too high for budget")

- Competitor Name (if applicable): Which dealership did they buy from?

- Competitor Price (if known): What price did competitor offer?

- Re-Engagement Flag: Should we follow up in 30/60/90 days?

Root Cause Analysis by Lost Reason

1. Price Objection (25-35% of Lost Leads)

What it means: Customer said vehicle or payments too expensive.

Root causes:

- Overpriced inventory: Your prices 10-15% above market comps

- Weak value communication: Didn't justify price (features, condition, warranty, service history)

- Budget mismatch: Showed customer $25K vehicles when budget was $18K

- Financing options not presented: Didn't offer lease, longer terms, larger down payment options

- Competitor undercut price: Lost on price war (need to match or justify premium)

How to fix:

- Pricing audit: Compare your prices to AutoTrader/CarGurus comps weekly. If consistently 10%+ over market, adjust.

- Value script training: "This vehicle is $2,000 more than similar listings because: new tires ($600), clean CarFax, 2-year warranty included ($1,200 value), recently serviced."

- Payment flexibility: "Can't afford $450/mo? Let's try 72-month term ($375/mo) or $2,000 down ($400/mo)."

- Match competitor offers (if profitable): "Dealer X offered $18,500? I can match that if you buy today."

2. Inventory Mismatch (15-25% of Lost Leads)

What it means: Customer couldn't find right vehicle (wrong color, features, type, price range).

Root causes:

- Limited inventory selection: Only 20 vehicles in stock, customer wants specific features you don't have

- Stocking wrong vehicles: Customer demand is for $15K sedans, but you stock $25K trucks

- Poor merchandising: Vehicle exists but customer couldn't find it (bad photos, missing options in listing)

- Not offering to locate vehicle: "We don't have that exact model, so I can't help" (vs dealer trade, auction sourcing)

How to fix:

- Inventory demand analysis: Track what customers ask for vs what you stock. If 40% of inquiries are for SUVs but only 20% of inventory is SUVs, rebalance.

- Vehicle locator service: "We don't have that exact [Vehicle], but I can source one from another dealer within 48 hours."

- Merchandising audit: Ensure all vehicles have 15+ photos, complete option lists, detailed comments.

- Alternative recommendations: "We don't have the [Exact Model], but this [Similar Model] has the same features + better fuel economy. Want to see it?"

3. Bought from Competitor (20-30% of Lost Leads)

What it means: Customer purchased from another dealership.

Root causes:

- Slow response time: Competitor called back first (speed-to-lead advantage)

- Better inventory match: Competitor had exact vehicle customer wanted

- Lower price: Competitor undercut by $1,000-$2,000

- Superior follow-up: Competitor followed up 10 times, you followed up 3 times

- Better customer experience: Competitor provided test drive, transparent pricing, less pressure

How to fix:

- Speed-to-lead improvement: Contact new leads within 5 minutes (not 1 hour). First to respond wins 50% of time.

- Persistent follow-up: Minimum 8-10 touchpoints over 30 days (not 2-3). Use automated email/SMS sequences.

- Competitive intelligence: Track which competitors you lose to most. Call them as mystery shopper - what are they doing better?

- Price match policy: "If you find a better price on same vehicle (year, mileage, condition), we'll match it."

4. No Response (15-25% of Lost Leads)

What it means: Customer stopped responding to calls, emails, texts.

Root causes:

- Low-quality lead: Customer wasn't serious (just browsing, price shopping, collecting quotes)

- Weak initial contact: First interaction was generic ("Hey, following up on your inquiry...") with no value

- Timing mismatch: Customer shopping for 3 months from now, but you're pushing immediate purchase

- Wrong channel: Calling customer who prefers text, or texting customer who prefers calls

- Gave up too soon: Only followed up 2-3 times before marking dead

How to fix:

- Lead qualification upfront: Ask on first call: "When are you looking to buy? This week, this month, or just researching?" Prioritize near-term buyers.

- Multi-channel approach: Alternate phone, email, SMS. If customer doesn't answer calls but opens emails, switch to email-first.

- Value-driven follow-up: Don't just say "checking in." Provide value: "New [Vehicle Type] just arrived - fits your budget. Want photos?"

- Persistence threshold: Don't mark lead dead until 12+ touchpoints over 30-45 days with zero engagement.

5. Timing/Not Ready (10-15% of Lost Leads)

What it means: Customer still shopping, not ready to commit (3-6 months timeline).

Root causes:

- Long-term shopper: Customer researching for future purchase

- No urgency created: Didn't build urgency ("This vehicle won't be here next month - 3 other interested buyers")

- Financing not approved yet: Customer needs to save for down payment or improve credit first

How to fix:

- Long-term nurture campaign: Don't discard. Enroll in 90-day email sequence (weekly inventory alerts, financing tips, trade-in guides).

- Urgency tactics: "This [Vehicle] is priced to move - typically sells in 7-10 days. Want to lock it in before someone else does?"

- Financing pre-approval: "Not ready to buy today? Let's get you pre-approved now - you'll know your budget when the right vehicle arrives."

Lost Lead Reporting & Dashboards

Weekly Lost Lead Report

Purpose: Identify recent high-value lost leads and immediate action items.

- Leads lost this week: 18 (vs 15 last week)

- Top 3 loss reasons: Price (7), Inventory Mismatch (5), Bought from Competitor (4)

- High-value losses: [Customer Name] - $35K vehicle, lost to price ($2K over competitor)

- Action items: Review pricing on premium inventory (3+ vehicles priced 10%+ over market)

Monthly Lost Lead Dashboard

| Metric | This Month | Last Month | Trend |

|---|---|---|---|

| Total Leads Lost | 75 | 82 | -9% ✅ |

| Lost Lead Rate | 75% (75 lost ÷ 100 leads) | 78% | -3% ✅ |

| Conversion Rate | 25% | 22% | +3% ✅ |

| Top Loss Reason | Price (30%) | Price (35%) | -5% ✅ |

| Re-Engaged Leads | 12 (16% of lost leads) | 8 | +50% ✅ |

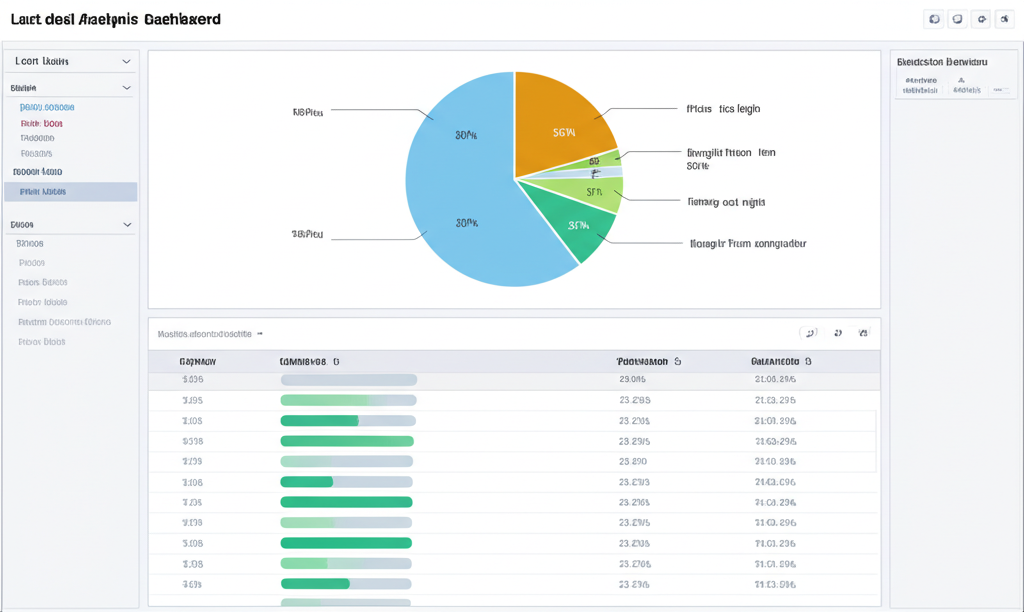

Lost Lead Breakdown (Pie Chart)

- Price Objection: 30% (23 leads)

- Inventory Mismatch: 20% (15 leads)

- Bought from Competitor: 25% (19 leads)

- No Response: 15% (11 leads)

- Timing/Not Ready: 7% (5 leads)

- Other: 3% (2 leads)

Lost Lead Re-Engagement Campaigns

20-30% of lost leads can be recovered with targeted re-engagement. Don't discard - nurture.

Re-Engagement Campaign 1: Price Objection Leads (30 Days Later)

Email Subject: "New financing options - lower payments available"

Email Body:

Hi [Name],

I know we couldn't make the numbers work last month on the [Vehicle]. Good news - we just partnered with a new lender offering 0% for 60 months (vs 6% before). This drops your payment from $450/mo to $385/mo.

The [Vehicle] is still here. Want to revisit the numbers? I can get you approved today.

- [Rep Name]

Re-Engagement Campaign 2: Inventory Mismatch Leads (Triggered)

Trigger: New vehicle arrives matching lost lead's preferences (make, model, price range)

SMS: "Hi [Name], we just got the [Year Make Model] you were looking for - $18,500, [Color], low miles. First to see it? Call me: [Phone]."

Re-Engagement Campaign 3: Bought from Competitor (90 Days Later)

Email Subject: "How's your [Vehicle]? Trade-in offer ready."

Email Body:

Hi [Name],

Congrats on your [Vehicle]! I know you bought elsewhere, but I wanted to check in - how's it treating you?

If you're ever ready to upgrade, I'd love to earn your business. As a thank-you for considering us before, here's $500 off your next vehicle + VIP trade-in appraisal (no appointment needed).

- [Rep Name]

CRM Automation for Lost Lead Analysis

Automation Rule 1: Lost Reason Requirement

- Trigger: Sales rep attempts to change lead status to "Lost"

- Action: Display popup: "Select lost reason (required)" + "Add notes (optional)"

- Validation: Cannot mark lost without selecting reason

Automation Rule 2: Manager Alert (High-Value Lost Leads)

- Trigger: Lead marked lost + vehicle price > $25,000

- Action: Email sales manager: "High-value lead lost: [Customer Name] - [Vehicle] - Reason: [Price Objection]. Review and approve."

- Follow-up: Manager can override loss status and reassign to closer

Automation Rule 3: Re-Engagement Enrollment

- Trigger: Lead marked lost + Re-engagement flag = Yes

- Action: Enroll in automated re-engagement campaign (30-day delay, then email + SMS sequence)

- Content: Tailored to lost reason (Price → financing options, Inventory → new arrival alerts, Timing → long-term nurture)

Automation Rule 4: Monthly Lost Lead Report

- Trigger: First day of each month (automated report)

- Action: Generate lost lead summary email to sales manager + owner: Total lost, breakdown by reason, trend vs last month, top 5 high-value losses

- Attachments: CSV export of all lost leads for deeper analysis

Frequently Asked Questions

What is a lost lead in automotive sales?

A lost lead is a customer who expressed interest (submitted inquiry, visited dealership, test drove) but did not purchase. Lost leads are categorized by reason: price objection, inventory mismatch, purchased from competitor, no response, or timing/readiness issues.

Why is lost lead analysis important?

Analyzing why leads are lost reveals fixable problems in your sales process, inventory strategy, or pricing. If 40% of lost leads cite 'price too high,' you have a pricing or value communication issue. Systematic analysis can improve conversion rates by 15-30%.

How do I track lost lead reasons in my CRM?

Create standardized 'Lost Reason' dropdown in CRM with categories: Price Objection, Inventory Mismatch, Bought from Competitor, No Response, Timing (Not Ready), Financing Declined, Vehicle Sold Before Contact. Require sales reps to select reason + add notes when marking lead as lost.

Can lost leads be re-engaged?

Yes. 20-30% of lost leads return within 90 days if followed up properly. Create re-engagement campaigns: 'Still looking for a [Vehicle Type]? We have new arrivals + $500 loyalty credit.' Target price objections with financing alternatives, inventory mismatch with alerts when matching vehicles arrive.

What is a good lost lead rate for car dealerships?

If your conversion rate is 20%, your lost lead rate is 80% (inverse relationship). Focus on reducing lost lead rate by fixing top 3 loss reasons. Benchmark: reducing lost leads by 10% (e.g., 80% → 70%) increases sales by 50% (20% → 30% conversion).

How often should I review lost lead reports?

Weekly: Review top loss reasons and recent high-value lost leads. Monthly: Analyze trends (are price objections increasing?), benchmark against last month, and implement process improvements. Quarterly: Strategic review - are we losing to same competitors repeatedly?

Stop losing deals to fixable problems.

DealerOneView CRM includes lost lead tracking with standardized reason categories, automated re-engagement campaigns, lost lead dashboards, and manager alerts for high-value losses. Identify why deals fall through and fix the gaps.

See Lost Lead Analytics in Action →

Related Articles

Get More Insights Like This

Subscribe to our newsletter for the latest dealership tips and industry trends.