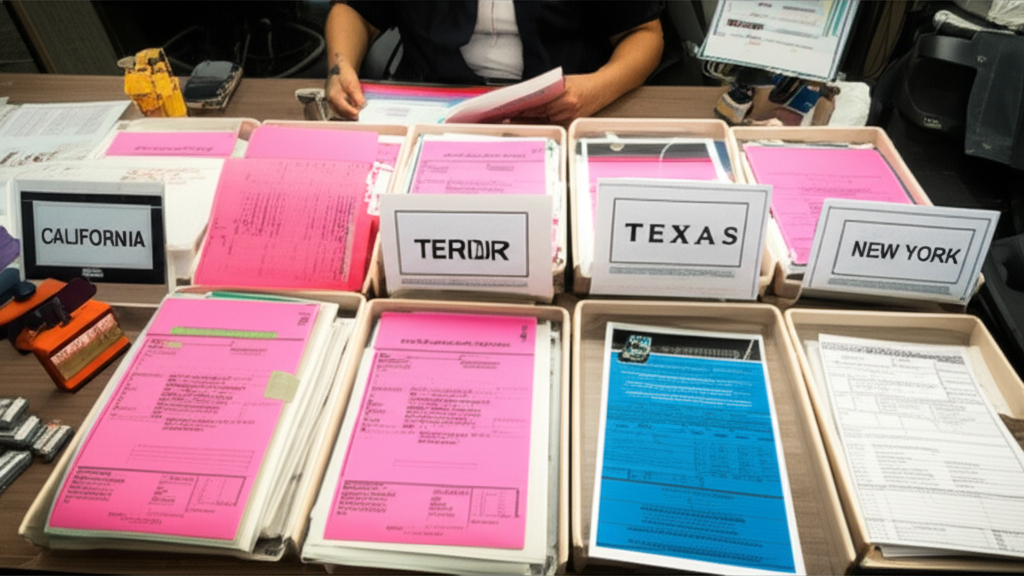

State DMV Title/Registration Workflows

DMV title transfer process by state: required documents, timing requirements, fees, lien releases. Streamline registration for faster delivery.

DMV title and registration errors cost dealers an average of $450 per mistake (resubmission fees, late penalties, staff time) and 2-4 weeks in delays. A 2024 study by the National Independent Automobile Dealers Association (NIADA) found 23% of dealer DMV submissions are rejected on first attempt due to paperwork errors. Electronic title states (ELT) have reduced errors to 12%, but most states still use paper processes with strict document requirements.

This guide covers DMV title transfer workflows, registration requirements, temporary tag rules, sales tax collection, and state-specific procedures for major markets (California, Texas, Florida, New York) plus general best practices applicable to all 50 states.

Universal DMV Requirements (All 50 States)

Required Documents for Title Transfer

| Document | Purpose | Common Errors |

|---|---|---|

| Original Title | Proof of ownership transfer | Missing seller signature, unsigned by all owners, lienholder not released |

| Bill of Sale | Transaction record (price, date, parties) | Missing signatures, no sale price listed, incorrect VIN |

| Odometer Disclosure | Federal requirement (vehicles <20 years old) | Missing mileage, unsigned, exceeds physical limit, "not actual" not explained |

| Buyer's ID | Verify buyer identity | Expired license, name doesn't match title, out-of-state ID without proof of residency |

| Dealer Reassignment Form | If dealer didn't title vehicle in their name (wholesale) | Missing dealer signature/stamp, incomplete fields |

Odometer Disclosure Rules (Federal - Applies to All States)

Requirement: Federal odometer disclosure required for vehicles less than 20 years old. Must be on title OR separate odometer disclosure statement.

Required Fields:

- Odometer reading at time of transfer

- Certification: "To the best of my knowledge, the odometer reading reflects actual mileage"

- OR check boxes: "Not actual mileage" (explain why), "Exceeds mechanical limits" (if odometer rolled over)

- Seller and buyer signatures + date

Penalty for False Disclosure: Federal: $10,000 fine + 3× damages. State: $5,000-$25,000 + potential license revocation.

California DMV Workflow

Title Transfer Process

Timeline: 4-6 weeks (paper title) or 2-3 weeks (electronic title via ELT system)

Required Documents (Beyond Universal):

- Smog Certificate: Valid smog certification (maximum 90 days old). Required for vehicles 1976+ (with exceptions for diesel, electric, hybrid plug-in, motorcycles). Seller's responsibility to provide.

- REG 262 (Smog Transfer Fee): $8 fee if smog certificate over 90 days old (buyer pays for new test).

- REG 343 (Vehicle/Vessel Transfer and Reassignment): If dealer reassigning title without titling in dealer name.

- Sales Tax Payment: Use tax collected at 7.25% base + local district tax (total 7.25%-10.25% depending on buyer's county).

Temporary Tags (Report of Sale - REG 51)

Duration: 90 days (longest in US)

Dealer Responsibilities:

- Submit REG 51 (Report of Sale) to DMV within 5 calendar days of sale (online submission at dmv.ca.gov)

- Provide buyer with temp registration card (pink copy of REG 51)

- Dealer keeps yellow copy for records (10 years retention)

- Submit permanent registration (title transfer) within 30 days to avoid late fees

Penalty for Late REG 51: $50 penalty if not submitted within 5 days. DMV can suspend dealer license for repeated violations.

Sales Tax Collection

Tax Rate: 7.25% state base + 0.25%-2.5% local district tax = 7.25%-10.25% total (varies by buyer's address)

Trade-In Deduction: Allowed. Tax calculated on (Sale Price - Trade-In Value).

Remittance: Dealers collect sales tax at sale and remit to CDTFA (California Department of Tax and Fee Administration) quarterly or monthly (if >$17,000 tax liability per quarter).

Texas DMV Workflow

Title Transfer Process

Timeline: 2-3 weeks (Texas uses electronic title system for most vehicles - eTitles processed faster)

Required Documents (Beyond Universal):

- Form 130-U (Application for Texas Title): Must be completed by buyer, signed by dealer.

- VTR-346 (Motor Vehicle Transfer Notification): Dealer must submit within 30 days of sale (protects dealer from liability for buyer's traffic violations).

- Emissions Test (if applicable): Required for vehicles in certain counties (Harris, Dallas, Tarrant, Travis, etc.). Not statewide like California.

- Sales Tax Payment: 6.25% state + up to 2% local tax (collected at sale, remitted via Form 130-U).

Temporary Tags (Buyer's Temporary Tag)

Duration: 30 days (dealer issues, buyer displays in rear window)

Dealer Responsibilities:

- Issue temporary tag at sale (print from Texas DMV system - requires dealer login)

- Tag displays: Dealer name, tag number, expiration date, vehicle VIN

- Submit Form 130-U (title transfer) and VTR-346 (transfer notification) within 30 days

- Fee: $5 temporary tag fee (dealer collects from buyer)

Penalty for Late Submission: $25-$100 late penalty if title application not submitted within 30 days.

Sales Tax Collection

Tax Rate: 6.25% state motor vehicle sales tax + up to 2% local tax (varies by county) = 6.25%-8.25% total

Trade-In Deduction: Allowed. Tax calculated on (Sale Price - Trade-In Allowance).

Remittance: Collected at sale, remitted to county tax assessor-collector when submitting title application (Form 130-U).

Florida DMV Workflow

Title Transfer Process

Timeline: 7-10 days (Florida has electronic title system - fastest in US for clean titles)

Required Documents (Beyond Universal):

- HSMV 82040 (Application for Certificate of Title): Buyer completes, dealer signs as seller.

- Proof of Insurance: Florida requires proof of insurance at registration (PIP and PDL coverage).

- VIN Inspection (if out-of-state vehicle): Law enforcement or DMV-authorized agent must verify VIN matches title.

- Sales Tax Payment: 6% state sales tax (collected at sale, remitted to county tax collector).

Temporary Tags (30-Day Temporary Tag)

Duration: 30 days

Dealer Responsibilities:

- Issue temporary tag at sale (metal plate or paper tag depending on county)

- Submit HSMV 82040 (title application) within 30 days

- Fee: $15 temporary tag fee (higher in some counties)

Penalty for Late Submission: $10 late fee if title not transferred within 30 days. Additional $10 for each subsequent 30-day period (up to $100 maximum).

Sales Tax Collection

Tax Rate: 6% state sales tax (no local add-ons for vehicles)

Trade-In Deduction: Allowed. Tax calculated on (Sale Price - Trade-In Allowance).

Remittance: Collected at sale, remitted to county tax collector when submitting title application.

New York DMV Workflow

Title Transfer Process

Timeline: 3-4 weeks (paper title system - NY does not use electronic titles statewide yet)

Required Documents (Beyond Universal):

- MV-82 (Vehicle Registration/Title Application): Buyer completes.

- DTF-802 (Sales Tax Transaction Return): Dealer completes to report sales tax collected.

- Proof of Sales Tax Payment: Buyer must pay sales tax before title transfer (dealer collects and remits).

- Emissions Inspection (if applicable): Required in certain counties (NYC, Long Island, some upstate). Valid inspection sticker must be on vehicle at sale.

Temporary Tags (In-Transit Permit)

Duration: 30 days

Dealer Responsibilities:

- Issue in-transit permit (paper tag) at sale

- Submit MV-82 (registration application) within 180 days (but dealer's liability for vehicle continues until transfer complete, so best practice is 30 days)

- Fee: $10 in-transit permit

Penalty for Late Submission: $25-$100 late penalty if registration not completed within 180 days.

Sales Tax Collection

Tax Rate: 4% state sales tax + local tax (varies by county) = 7%-8.875% total (NYC highest at 8.875%)

Trade-In Deduction: NOT allowed in New York. Sales tax calculated on full sale price regardless of trade-in.

Remittance: Collected at sale, remitted to NYS Department of Taxation and Finance quarterly (or monthly if >$300K annual sales tax liability).

Lien Releases and Payoffs

Selling Vehicle with Existing Lien

Process:

- Obtain Payoff Quote: Contact lienholder (bank, credit union, finance company) for 10-day payoff amount.

- Pay Lien: Send payoff via wire transfer (fastest - same day) or cashier's check (3-5 business days).

- Lienholder Releases Title: Timing varies:

- Electronic lien states (ELT): 1-3 business days (lienholder releases electronically)

- Paper title states: 7-14 days (lienholder mails title with lien release stamp/letter)

- Transfer to Buyer: Once clear title received, complete transfer to buyer per state process.

Electronic Lien and Title (ELT) States

ELT States (Faster Lien Release): California, Texas, Florida, Arizona, Virginia, Ohio, Pennsylvania, North Carolina, South Carolina, Georgia, Maryland, Connecticut, Utah (31 states total as of 2026)

Benefit: Lienholder releases title electronically to DMV (1-3 days). Dealer can print title immediately after release OR DMV mails title to dealer.

Non-ELT States (Slower): Lienholder must mail paper title with lien release stamp/letter (7-14 days). No expedited option.

Out-of-State Title Transfers

When Buyer Registers Vehicle in Different State Than Dealer

Common Scenario: California dealer sells to Texas buyer. Buyer wants to register vehicle in Texas.

Process:

- Dealer Provides: Original title (signed), bill of sale, odometer disclosure, any dealer-required state forms (e.g., CA REG 51 still required even if buyer registers elsewhere).

- Buyer Submits to Home State DMV: Buyer takes documents to Texas DMV and applies for Texas title/registration.

- VIN Inspection (Usually Required): Most states require VIN inspection for out-of-state vehicles to verify VIN matches title and check for theft.

- Sales Tax: Buyer pays sales tax in registration state (Texas in this example), not purchase state (California). Dealer does NOT collect California sales tax if buyer provides proof of out-of-state registration intent.

Dealer Best Practice: Obtain written statement from buyer confirming out-of-state registration + copy of buyer's out-of-state driver's license. Protects dealer from sales tax audit.

Common DMV Rejection Reasons

| Rejection Reason | Frequency | How to Fix | Delay |

|---|---|---|---|

| Missing signature on title | 35% | Obtain seller signature, resubmit | 2-4 weeks |

| Odometer disclosure incomplete | 20% | Complete odometer statement, resubmit | 2-3 weeks |

| Lienholder not released | 15% | Obtain lien release from bank, resubmit | 1-4 weeks |

| Expired smog certificate (CA) | 10% | New smog test ($50-90), resubmit | 1-2 weeks |

| Incorrect VIN | 8% | Correct VIN, verify with physical inspection | 2-3 weeks |

| Missing dealer stamp/signature | 7% | Dealer re-signs/stamps documents | 2-3 weeks |

| Sales tax not paid (NY) | 5% | Pay sales tax, obtain receipt, resubmit | 1-2 weeks |

Best Practices to Avoid Delays

Document Checklist (Review Before Submission)

- [ ] Title signed by ALL listed owners (if joint ownership, both must sign)

- [ ] Odometer disclosure complete and signed (for vehicles <20 years old)

- [ ] Lienholder released (if applicable) - verify lien release stamp OR separate letter

- [ ] Bill of sale includes: VIN, sale price, date, buyer/seller names, signatures

- [ ] State-specific forms complete (CA: REG 51, TX: VTR-346, FL: HSMV 82040, NY: MV-82)

- [ ] Sales tax collected and remittance ready

- [ ] VIN matches title exactly (check for O vs 0, I vs 1 errors)

- [ ] Buyer's ID current and name matches title

Technology Solutions

- Electronic Title Services: Use state ELT systems where available (CA, TX, FL) for faster processing.

- DMV Integration Software: DMS systems with DMV integrations auto-populate forms and validate data before submission (reduces errors by 60%).

- Lien Payoff Services: Third-party services (e.g., RouteOne, DealerTrack) handle lien payoff + title retrieval (saves 3-7 days).

Record Retention Requirements

Federal: Odometer disclosure records must be kept for 5 years.

State (Typical): Title transfer documents, bills of sale, temporary tag records must be kept for 3-7 years (varies by state).

Best Practice: Scan all DMV documents and store electronically. Retain for 7 years to cover longest state requirement and potential audit lookback periods.

Frequently Asked Questions

How long does DMV title transfer take?

Varies by state: California 4-6 weeks, Texas 2-3 weeks, Florida 7-10 days, New York 3-4 weeks. Electronic title states (FL, TX, CA) process faster than paper states. Expedited processing available in most states for $10-50 fee.

What documents are required for title transfer?

All states require: Original title (signed by seller), bill of sale, odometer disclosure (vehicles <20 years old), buyer's ID. Additional state-specific: CA requires smog certificate, NY requires sales tax payment proof, FL requires insurance proof.

Who pays sales tax - dealer or buyer?

Buyer pays sales tax in ALL states. Dealer collects tax at sale and remits to DMV/tax authority. Exception: Trade-in value reduces taxable amount in most states (not all). Tax rates vary: 0% (no sales tax states) to 9%+ (CA, some TX cities).

Can I sell a vehicle with a lienholder on the title?

Yes, but you must obtain title release (lien satisfaction) from lender before transferring to buyer. Process: Pay off lien → lender releases title (2-14 days depending on lender) → dealer receives clear title → transfer to buyer. Some states allow electronic lien release (ELT) for same-day processing.

What are temporary/transit tags rules?

Temporary tags allow buyer to drive vehicle before permanent registration. Duration varies: CA 90 days, TX 30 days, FL 30 days, NY 30 days. Dealer must submit permanent registration within temp tag period or face fines. Some states charge temp tag fee ($5-25).

What happens if I submit wrong paperwork to DMV?

DMV rejects submission and returns documents. Causes delays (2-4 weeks) and potential late fees if permanent registration deadline missed. Common errors: Missing signature, incorrect odometer reading, unsigned lien release, expired smog certificate (CA), missing VIN inspection (out-of-state vehicles).

Automate DMV paperwork and eliminate errors.

DealerOneView includes state-specific DMV forms with validation, electronic lien payoff integration, automatic sales tax calculation, temporary tag printing, and document retention tracking. Reduce DMV rejections by 70%.

See DMV Automation →

Related Articles

Get More Insights Like This

Subscribe to our newsletter for the latest dealership tips and industry trends.